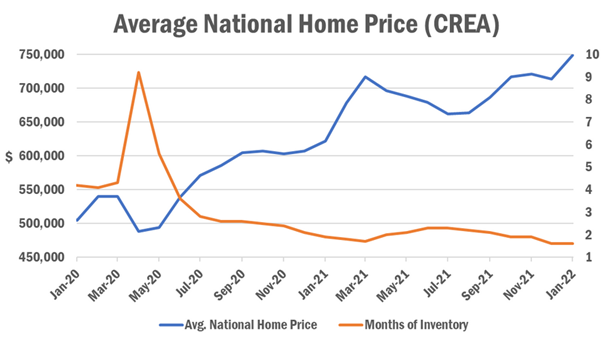

The increased purchase of homes in different provinces of Canada has left the country with very few houses for sale. The Canadian Real Estate Association (CREA) estimated that approximately 86,000 homes were left available for sale at the December 2021. Over the course of 2021, buyers purchased nearly 667,000 homes which is 20% more than the previous year’s record. Because of such rapid purchase, housing shortage has pushed the prices of homes further.

In January, the average price of a home was $748,450, and this was 1% higher than in December 2021 and 21% higher compared to the previous year. In comparison to the pre-pandemic levels in January 2020, a 46.5% increase has been perceived in the MLS Home Price Index. CREA has revealed that because of the real-estate frenzy, there is an acute lack of inventory, and this has resulted in an increase to the average selling price of homes.

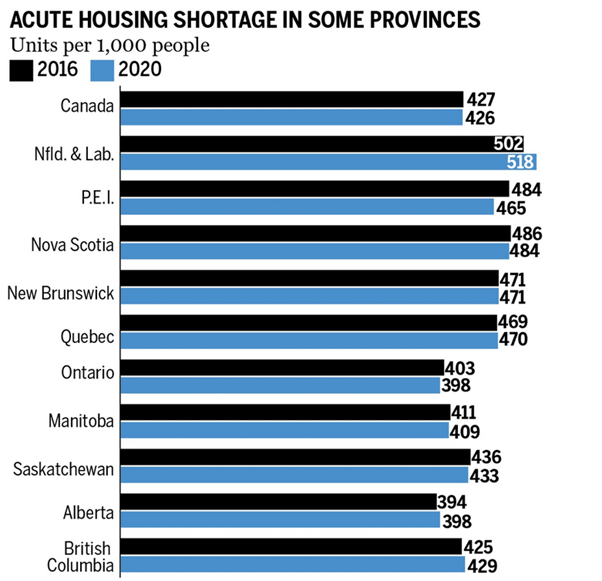

The most pronounced shortage of homes can be seen in the province of Ontario followed by Alberta and Manitoba. This has decreased the average housing stock per capita to below the national level. Furthermore, amongst the G7 countries, Canada already has the lowest average housing supply per capita. Canada is able to supply only 424 units per 1000 people. This places the country behind the United States and the United Kingdom. In comparison, France is able to provide 540 units per 1000.

In order for the Government of Canada to meet the housing demand and ensure that the prices of houses are controlled, the country needs to build nearly 138,000 houses in Alberta, and 23,000 more in Manitoba. It is also essential to highlight that although Ontario, Alberta, and Manitoba perceive shortage of home, this does not mean that ample houses are not available in other Canadian provinces.

Moreover, in each Canadian provinces, the prices of homes continuously soar. In the previous month alone, the average pricing has increased by $51,900 in Greater Toronto Area, $44,100 in Barrie, $25,000 in Greater Vancouver Area, $12,300 in Greater Montreal, and $7,600 in Calgary. Some additional regional data is as follows:

- Alberta: $443,398 (+10%)

- B.C.: $1,040,888 (+23.3%)

- Barrie & District: $880,300 (+39.3%)

- Calgary: $458,800 (+11.4%)

- Greater Montreal Area: $530,100 (+22%)

- Greater Toronto Area: $1,259,900 (+33.1%)

- Greater Vancouver Area: $1,255,200 (+18.5%)

- Halifax-Dartmouth: $560,237 (+29.7%)

- Ontario: $998,629 (+25.6%)

- Ottawa: $689,700 (+16%)

- Quebec: $474,941 (+16.3)

- St. John’s: $291,300 (+10.2%)

- Victoria: $920,400 (+24.9%)

- Winnipeg: $331,300 (+13%)

- Edmonton: $339,600 (+5.2%)

There are several other factors which play a major role in the supply and demand of houses which has resulted in this shortage. For example, the Canadian government has announced that it plans to admit nearly 450,000 immigrants per year. This equates to admitting new immigrants at a rate of about 1% of Canada’s population per year. In other words, in 2022, 2023, and 2024, nearly 431,645, 447,055, and 451,000 immigration applications will be accepted by the government respectively. Subsequently, the reason for large number of immigrants being admitted to the country is to fill the labour shortage in the market.

Another reason for increasing housing prices shortages is the increase in interest rates. In January, the Bank of Canada revealed that it would be increasing their interest rates in the following weeks. This will a significant impact on housing demands and markets are estimating that the country would require large-scale hiking to resolve these demand issues.